Wei Heng Fai Ambrose Chan

Chairman of the Board

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant[X]

Filed by a Party other than the Registrant[ ]

Check the appropriate box:

| [ | Preliminary Proxy Statement |

| [ ] | Confidential, for the use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| [ | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

| DOCUMENT SECURITY SYSTEMS, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-1l (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

DOCUMENT SECURITY SYSTEMS, INC.

200 CANAL VIEW BOULEVARD, SUITE 300

ROCHESTER, NEW YORK 14623

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of Stockholders (the “Annual Meeting”) of Document Security Systems, Inc. (the “Company”, “we”, “us” or “our”) will be held on Tuesday, June 28, 2016,December 9, 2019, at 11:0010:30 a.m. (Eastern Standard Time) at 200 Canal View Boulevard, Suite 300, Rochester,the Grand Hyatt New York, 14623109 East 42nd Street at Grand Central Terminal, New York, New York, 10017, for the purposes of:

| 1. | ||

| 2. | ||

| 3. | Approving the Company’s 2020 Equity Incentive Plan (the “2020 Incentive Plan”); | |

| 4. | Conducting an advisory vote on executive compensation; | |

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice.

The Board of Directors has fixed the close of business on Friday, April 29, 2016November 4, 2019 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournment or postponement thereof.

This year, we are again implementing the “Notice and Access” method approved by the Securities and Exchange Commission that allows companies to provide proxy materials to stockholders via the Internet. The Internet will be used as our primary means of furnishing proxy materials to our stockholders. Consequently, stockholders will not receive paper copies of our proxy materials. We will instead send stockholders a notice with instructions for accessing the proxy materials and voting via the Internet. The notice also provides information on how stockholders may obtaindelivering paper copies of our proxy materials if they so choose. This makesto stockholders. Accordingly, you are receiving all proxy materials by mail. These proxy materials include the proxy distribution process more efficientstatement, a WHITE proxy card and less costly.

A Notice of Internet Availability of Proxy Materials, which contains specific instructionsour Annual Report on how to access thoseForm 10-K, as amended. These proxy materials via the Internet and vote online, as well as instructions on how to request paper copies, will be mailed to our stockholders on or about May 16, 2016. *, 2019 to the stockholders of record on the Record Date

The Company’s Annual Report on Form 10-K, as amended and the Proxy Statement,proxy statement, along with any amendments to the foregoing materials that are required to be furnished to stockholders, will be available at https://materials.proxyvote.com/25614T.www.proxyvote.com.

| By order of the Board of Directors | |

| |

Wei Heng Fai Ambrose Chan Chairman of the Board |

WHETHER OR NOT YOU PLAN ON ATTENDING THE ANNUAL MEETING IN PERSON, PLEASE VOTE USING THE WHITE PROXY CARD AS PROMPTLY

AS POSSIBLE TO ENSURE THAT YOUR VOTE IS COUNTED.

DOCUMENT SECURITY SYSTEMS, INC.

200 CANAL VIEW BOULEVARD, SUITE 300

ROCHESTER, NEW YORK 14623

PROXY STATEMENT FOR THE COMPANY’S

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 28, 2016DECEMBER 9, 2019

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

Why am I receiving these proxy materials?

The proxy materials describe the proposals on which our Board of Directors would like you, as a stockholder, to vote on at the Annual Meeting. The materials provide you with information on these proposals so that you can make an informed decision. We intend to mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record entitled to vote at the Annual Meeting.

Who can vote at the Annual Meeting of Stockholders?

Stockholders who owned shares of common stock of the Company, par value $0.02 per share (the “Common Stock”), as of April 29, 2016,November 4, 2019, the Record Date, may attend and vote at the Annual Meeting. Each share is entitled to one vote. There were 51,881,948[ ] shares of Common Stock outstanding as of the Record Date. All shares of Common Stock shall vote together as a single class.

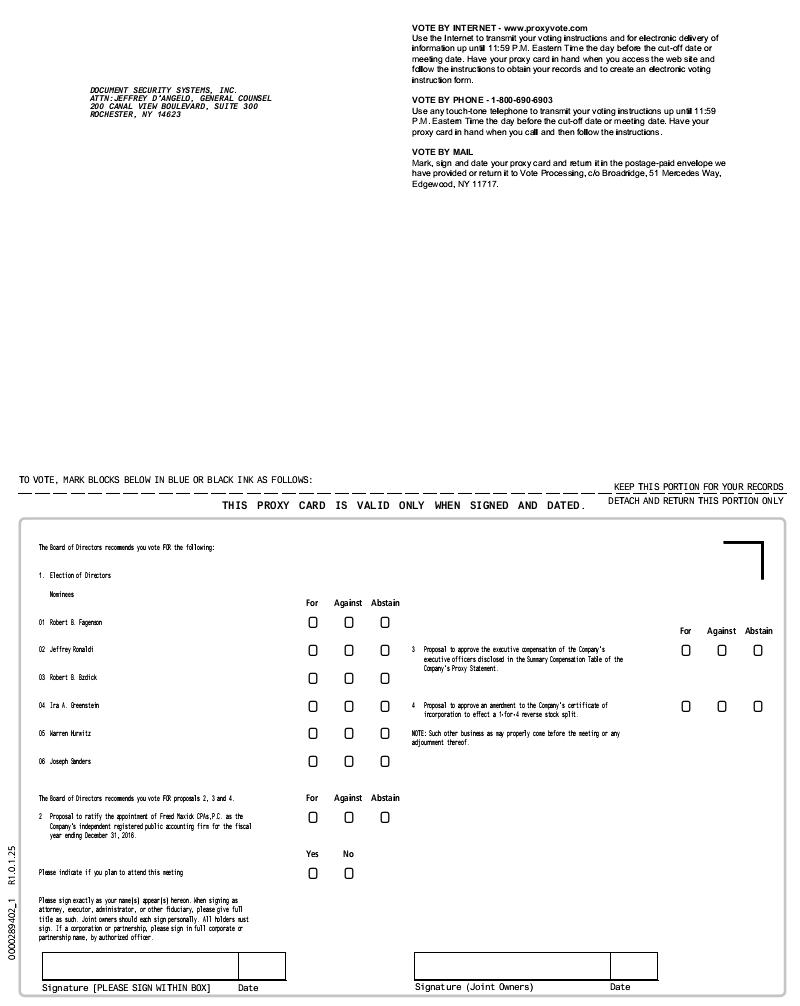

What is the proxy card?

The proxy card enables you to appoint the persons named therein as your representative to vote your shares at the Annual Meeting, and to provide specific instructions as to how you wish your shares to be voted. By completing and returning theWHITE proxy card, you are authorizing these persons to vote your shares at the Annual Meeting in accordance with your instructions on theWHITE proxy card. By providing specific voting instructions for each proposal identified on the WHITE proxy card, your shares will be voted in accordance with your wishes whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we suggest that you complete and return your WHITE proxy card before the Annual Meeting date just in case your plans change. If a routine proposal comes up for vote at the Annual Meeting that is not on thea proxy card, your appointed representative will vote your shares, under your proxy, according to their best judgment.

What am I voting on?

You are being asked to vote on the election of the Company’s Board of Directors, on the ratification of the appointment of Company’s independent registered public accountants for the fiscal year ending December 31, 2016,2019, for approval of executivethe Company’s 2020 Incentive Plan, for approval of the compensation as disclosed in this Proxy Statement of the Company’s executive officers who are named in this Proxy Statement’s Summary Compensation Table, and for approvalon the frequency of an amendment to the Company’s certificate of incorporation to effect a 1-for-4 reverse stock split.future advisory votes on executive compensation. We may also transact any other business that properly comes before the Annual Meeting.

How does the Board of Directors recommend that I vote?

Our Board of Directors unanimously recommends that the stockholders vote “For” each of the nominees for director named below, “For” the ratification of the appointment of the Company’s independent registered public accountants for the fiscal year ending December 31, 2016,2019, “For” approval of the 2020 Incentive Plan, “For” approval of executive compensation as disclosed in this Proxy Statement, and for “one year” with respect to the frequency of advisory votes on executive compensation.

How are proxy materials being made available to shareholders?

We have opted to provide our materials pursuant to the Company’s executive officers whofull set delivery option in connection with the Annual Meeting. Under the full set delivery option, a company delivers all proxy materials to its shareholders. The approximate date on which the proxy statement and proxy card are named in this Proxy Statement’s Summary Compensation Table, and “For” approval of an amendmentintended to be first sent or given to the Company’s certificateshareholders (each a “Shareholder”, and collectively, the “Shareholders”) is [*], 2019. This delivery can be by mail or, if a shareholder has previously agreed, by e-mail. In addition todelivering proxy materialsto shareholders, the Company must also post all proxy materials on a publicly accessible website and provide information to shareholders about how to access that website. Accordingly, you should have received our proxy materials by mail or, if you previously agreed, by e-mail. These proxy materials include this Notice of incorporation to effect a 1-for-4 reverse stock split.Annual Meeting of Stockholders, proxy statement, and proxy card. These materials are available free of charge atwww.proxyvote.com.

What is the difference between holding shares as a stockholder of record and holding shares as a beneficial owner?

Most of our stockholders hold their shares in an account at a brokerage firm, bank, broker dealer or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Registered Stockholders (Stockholders of Record)

If on the Record Date, your shares were registered directly in your name with our transfer agent, American Stock Transfer and Trust Company, LLC, you are a stockholder of record who may vote at the Annual Meeting. As the stockholder of record, you have the right to direct the voting of your shares via the internet or telephone or, if you request, by returning a WHITE proxy card to us. You may also vote in person at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please vote via the internet or telephone, or if you request, complete, date and sign a WHITE proxy card and provide specific voting instructions to ensure that your shares will be voted at the Annual Meeting.

Beneficial Owner

If on the Record Date, your shares were held in an account at a brokerage firm, bank, broker-dealer or other similar organization, you are considered the beneficial owner of shares held “in street name”, and the Notice isour proxy materials are being forwarded to you by that organization. The organization holding your account is considered the shareholderstockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct your nominee holder on how to vote your shares and to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from your brokerage firm, bank, broker dealer or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage firm, bank, broker dealer or other nominee holder. If you do not make this request, you can still vote by following the voting instructions contained in the Notice;materials you received from your brokerage firm, bank, broker dealer or other nominee; however, you will not be able to vote in person at the Annual Meeting.

How do I Vote?vote?

Stockholders of record (also called registered stockholders) may vote by any of the following methods:

A. By mail: if you request or receive proxy materials by mail, you may vote by completing the WHITE proxy card with your voting instructions and returning it in the postage-paid envelope provided.provided to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

If we receive your WHITE proxy card prior to the Annual Meeting date and you have marked your voting instructions on the WHITE proxy card, your shares will be voted:

| ● | as you instruct, and | |

| ● | as your proxy representative may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. |

B. By Internet: read the proxy materials and follow the instructions provided inon the Notice.proxy card.

C. By toll-free telephone: read the proxy materials and call the toll free number provided for in the instructions on the proxy voting instructions.card.

D. In person at the Annual Meeting.

If your shares are held in the name of a broker, bank, broker dealer or other nominee holder of record, you may vote by any of the following methods:

A. By Mail: If you request or receive printed copies of the proxy materials by mail, you may vote by completing the proxy cardvoting instruction form with your voting instructions and returning it to your broker, bank, broker dealer or other nominee holder of record prior to the Annual Meeting.

B. By Internet: You may vote via the Internet by following the instructions provided in the Notice mailed tomaterials you byreceived from your nominee holder.

C. By toll-free telephone: You may vote by calling the toll free telephone number foundprovided in the proxy voting instructions.materials you received from your nominee holder.

D.D In Person: If you are a beneficial owner of shares held in street name and you wish to vote in person at the Annual Meeting, you must obtain a valid proxy from the nominee organization that holds your shares.

Why did I receive a Notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission, the Company has elected to provide access to its proxy materials over the Internet. Accordingly, the Company is sending such Notice to the Company’s stockholders of record and beneficial owners. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Company encourages you to take advantage of the availability of the proxy materials on the Internet.

What does it mean if I receive more than one WHITE proxy card?card or voting instruction form?

You may have multiple accounts at the transfer agent and/or with brokerage firms. Please sign and return all WHITE proxy cards, and provide your voting instructions, to ensure that all of your shares are voted for each of the proposals.

What if I change my mind after I return my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting. You may do this by:

| ● | sending a written notice to the Secretary of the Company stating that you would like to revoke your proxy of a particular date; | |

| ● | signing another proxy card with a later date and returning it before the polls close at the Annual Meeting; | |

| ● | ||

| the proxy card;] | ||

| ● | attending the Annual Meeting and voting in |

Please note, however, that if your shares are held of record by a brokerage firm, bank, broker dealer or other nominee, you must instruct your broker, bank, broker dealer or other nominee that you wish to change your vote by following the procedures on the voting form provided to you by the broker, bank, broker dealer or other nominee. If your shares are held in street name, and you wish to attend the Annual Meeting and vote at the Annual Meeting, you must bring to the Annual Meeting a legal proxy from the broker, bank, broker dealer or other nominee holding your shares, confirming your beneficial ownership of the shares and giving you the right to vote your shares.

How are votes counted?

Consistent with state law and our bylaws, the presence, in person or by proxy, of at least a majority of the shares entitled to vote at the meeting will constitute a quorum for purposes of voting on a particular mattertransacting business at the meeting. Once a share is represented for any purpose at the meeting, it is deemed present for quorum purposes for the remainder of the meeting and any adjournment thereof unless a new record date is set for the adjournment. Shares held of record by stockholders or their nominees who do not vote by proxy or attend the meeting in person will not be considered present or represented and will not be counted in determining the presence of a quorum. Signed proxies that withhold authority or reflect abstentions and “broker non-votes” will be counted for purposes of determining whether a quorum is present. “Broker non-votes” are proxies received from brokerage firms or other nominees holding shares on behalf of their clients who have not been given specific voting instructions from their clients with respect to matters being voted on. Broker non-votes will be counted for purposes of establishing a quorum to conduct business at the meeting, but not for determining the number of shares voted FOR, AGAINST, ABSTAINING or WITHHELD FROM with respect to any matters.matters, as well as shares voted “ONE YEAR”, “TWO YEARS”, or “THREE YEARS” with respect to the advisory vote on the frequency of future advisory votes on executive compensation.

Assuming the presence of a quorum at the meeting:

| ● | ||

| ● | The ratification of the appointment of our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast | |

| ● | The approval of the Company’s 2020 Incentive Plan will be decided by the affirmative vote of a majority of the votes cast on this proposal | |

| ● | The advisory vote on executive compensation will be decided by the affirmative vote of a majority of the votes cast on this proposal at the meeting. | |

| ● | With regard to the advisory vote on the frequency of future advisory votes on executive compensation (Proposal 5), votes on the preferred voting frequency may be cast by choosing the option of one year, two years, three years, or “abstain” in response to this proposal. The | |

We strongly encourage you to provide instructions to your bank, brokerage firm, or other nominee by votingvote your proxy. This action ensures that your shares will be voted in accordance with your wishes at the meeting.

Is my vote kept confidential?

Proxies, ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed except as may be necessary to meet legal requirements.requirements.

Where do I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting. We will also file a Current Report on Form 8-K with the Securities and Exchange Commission within four business days of the Annual Meeting disclosing the final voting results.

Who can help answer my questions?

You can contact our corporate headquarters, at (585) 325-3610, or send a letter to: Investor Relations, Document Security Systems, Inc., 200 Canal View Boulevard, Suite 300, Rochester, New York 14623, with any questions about proposals described in this Proxy Statement or how to execute your vote.

You can also contact our proxy solicitor, The Proxy Advisory Group, LLC, with any questions or for assistance voting, at:

The Proxy Advisory Group, LLC

18 East 41st Street, Suite 2000

New York, New York 10017

1-212-616-2180

| 7 |

DOCUMENT SECURITY SYSTEMS, INC.

200 CANAL VIEW BOULEVARD, SUITE 300

ROCHESTER, NEW YORK 14623

PROXY STATEMENT

SOLICITATION OF PROXIES

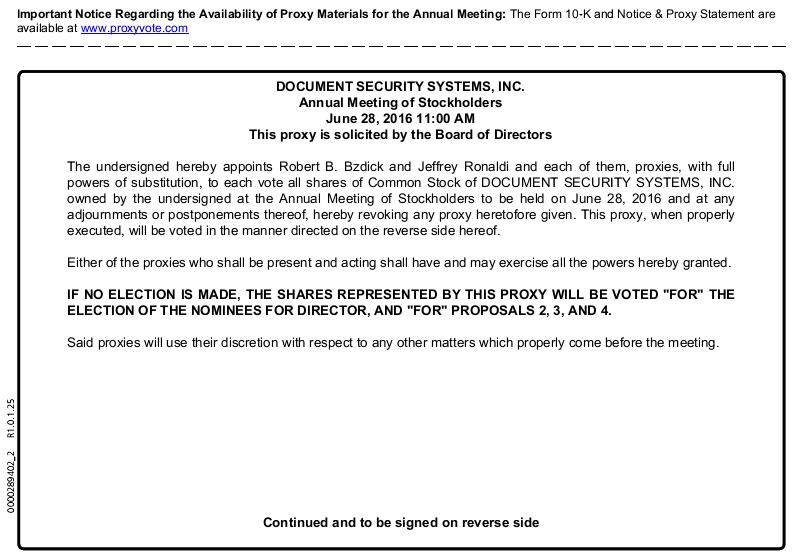

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Document Security Systems, Inc. (the “Company”), for use at the Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at 200 Canal View Boulevard, Suite 300, Rochester,Grand Hyatt New York, 14623109 East 42nd Street at Grand Central Terminal, New York, New York, 10017, on Tuesday, June 28, 2016,December 9, 2019, at 11:0010:30 a.m. (Eastern Standard Time) and at any adjournments or postponements thereof. Solicitation of proxies may be made by directors, officers, a solicitor or other employees of the Company. Compensation may be paid to a proxy solicitor should the Company determine that such services are required. This solicitation of proxies is being made by the Company which will bear all costs associated with the mailing of the proxy materials and the solicitation of proxies. Whether or not you expect to attend the Annual Meeting in person, and if you request and receive proxy materialsplease vote by mail, please returnreturning your executed WHITE proxy card in the enclosed envelope and the shares represented thereby will be voted in accordance with your instructions. The Notice of Internet Availability of Proxy Materials (the “Notice”) will be mailed to all stockholders on or about May 16, 2016. The proxy voting instructions accompanying the Notice describe the process for voting your shares via the Internet or by telephone. For stockholders who request mailings of the proxy materials, we will begin mailing the proxy materials to stockholders on or about May 19, 2016.

REVOCABILITY OF PROXY

Any stockholder executing a proxy that is solicited has the power to revoke it prior to the voting of the proxy. Revocation may be made by i) attending the Annual Meeting and voting the shares of stock in person, or byii) delivering to the Secretary of the Company at the principal office of the Company prior to the Annual Meeting a written notice of revocation or a later-dated, properly executed proxy.proxy, iii) signing another proxy card with a later date and returning it before the polls close at the Annual Meeting, or iv) voting again via the internet or by toll free telephone by following the instructions on the proxy card.

RECORD DATE

Stockholders of record at the close of business on April 29, 2016November 4, 2019 (the “Record Date”) will be entitled to vote at the Annual Meeting.

ACTION TO BE TAKEN UNDER PROXY

In the case of the Company receiving a WHITE signed proxy (“Proxy”) from a registered stockholder containing voting instructions “FOR” the election of each of the nominated directors, and “FOR” Proposals 2, 3 and 4, and “one year” for Proposal 5, the personsperson named in the Proxy (Robert Bzdick, Secretary of the Company, and Jeffrey Ronaldi,(Frank D. Heuszel, Chief Executive Officer of the Company), or either one of them who acts (the “Proxy Representative”), will vote:

| (1) | FOR the election of the persons named herein as nominees for directors of the Company; | |

| (2) | FOR ratification of the appointment of Freed Maxick CPAs, P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, | |

| (3) | FOR approval of | |

(4) | FOR approval of the compensation disclosed in this Proxy Statement of the Company’s executive officers who are named in this Proxy Statement’s Summary Compensation Table; | |

| (5) | “one year” with respect to the | |

| According to their judgment on the transaction of such matters or other business as may properly come up for vote at the Annual Meeting or any adjournments or postponements thereof. |

If the giver of the Proxy provides voting instructions to cast a vote “AGAINST” any or all of the nominated directors in Proposal 1, “AGAINST” Proposals 2, 3, or any4, or for a preferred frequency of the proposals,future votes on executive compensation different than “one year” for Proposal 5, the Proxy Representative will vote such shares accordingly. If the giver of the Proxy provides voting instructions to “ABSTAIN” from voting on any or all of the above proposals, the Proxy Representative will accordingly abstain from voting the shares accordingly.shares. For registered stockholders, if no specific voting instructions are given to the Proxy Representative, then the Proxy Representative will vote “FOR” the election of the director nominees set forth in Proposal 1, “FOR” Proposals 1, 2, 3, and 4, and for “one year” on Proposal 5, and according to their judgment on any other matters properly submitted for a vote at the Annual Meeting.

| 8 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth beneficial ownership of Common Stock as of March 31, 2016November 4, 2019 by each person known by the Company to beneficially own more than 5% of the Common Stock, each director, anddirector nominee for election as a director,and each of the executive officers named in the Summary Compensation Table (see “Executive Compensation” below), and by all of the Company’s directors, director nominees and executive officers as a group. Each person has sole voting and dispositive power over the shares listed opposite his or her name except as indicated in the footnotes to the table and each person’s address is c/o Document Security Systems, Inc., 200 Canal View Boulevard, Suite 300, Rochester, New York 14623.

For purposes of this table, beneficial ownership is determined in accordance with the Securities and Exchange Commission rules, and includes investment power with respect to shares owned and shares issuable pursuant to warrants or options exercisable within 60 days of March 31, 2016.November 4, 2019.

The percentages of shares beneficially owned are based on 51,881,94836,180,557 shares of our Common Stock issued and outstanding as of March 31, 2016,November 4, 2019, and is calculated by dividing the number of shares that person beneficially owns by the sum of (a) the total number of shares outstanding on March 31, 2016,November 4, 2019, plus (b) the number of shares such person has the right to acquire within 60 days of March 31, 2016.November 4, 2019.

| Name | Number of Shares Beneficially Owned | Percentage of Outstanding Shares Beneficially Owned | ||||||

| Robert Fagenson | 1,412,096 | (1) | 2.72 | % | ||||

| Jeffrey Ronaldi | 516,690 | (2) | * | |||||

| Robert B. Bzdick | 1,388,325 | (3) | 2.66 | % | ||||

| Ira A. Greenstein | 145,632 | (4) | * | |||||

| Warren Hurwitz | 45,000 | (5) | * | |||||

| Joseph Sanders | 927,673 | (6) | 1.79 | % | ||||

| Philip Jones | 96,620 | (7) | * | |||||

| All officers and directors as a group (7 persons) | 4,532,036 | 8.59 | % | |||||

| 5% Shareholders | ||||||||

| None | ||||||||

| Name | Number of Shares Beneficially Owned | Percentage of Outstanding Shares Beneficially Owned | ||||||

| Heng Fai Ambrose Chan (1) | 11,493,641 | 31.77 | % | |||||

| Frank Heuszel | 74,770 | * | ||||||

| Joseph Sanders | 441,939 | 1.22 | % | |||||

| SassuanLee | - | |||||||

| Jose Escudero | - | |||||||

| John Thatch | 30,575 | * | ||||||

| Lowell Wai Wah | 40,767 | * | ||||||

| William Wu | * | |||||||

| Jason Grady | 74,770 | * | ||||||

| Daniel DelGiorno | ||||||||

| All officers and directors as a group (10 persons) | 12,156,462 | 33.60 | % | |||||

| 5% Shareholders | ||||||||

| Heng Fai Ambrose Chan | See Above | See Above | ||||||

* Less than1%than 1%.

(1) Includes 1,135,3212,077,682 individually owned shares of the Company’s Common Stock, 76,775500,000 shares of the Company’s Common Stock issuable upon the exercise of currently exercisable stock options, 100,000owned by BMI Capital Partners International Limited, 1,786,531 shares of the Company’s Common Stock heldowned by Mr. Fagenson’s wife, and an aggregate of 100,000Heng Fai Holdings Limited, 6,446,428 shares of the Company’s Common Stock held in trusts for Mr. Fagenson’s two adult children, of which Mr. Fagenson is trustee. Mr. Fagenson disclaims beneficial ownership of the 100,000owned by LiquidValue Development Pte Ltd, and 683,000 shares of the Company’s Common Stock heldowned by his wife and the 100,000 sharesHengfai Business Development Pte. Ltd. Mr. Chan has dispositive power over all of the Company’s Common Stock held in trusts for Mr. Fagenson’s two adult children.these shares.

(2) Includes 296,187 shares of the Company’s Common Stock, 207,101 shares of the Company’s Common Stock issuable upon exercise of stock options within 60 days of March 31, 2016, and 13,402 shares of the Company’s Common Stock issuable upon exercise of warrants with an exercise price of $4.80.

(3) Includes 1,019,982 shares of the Company’s Common Stock and 368,343 shares of the Company’s Common Stock issuable upon the exercise of stock options within 60 days of March 31, 2016.

(4) Includes 28,857 shares of the Company’s Common Stock and 116,775 shares of the Company’s Common Stock issuable upon the exercise of stock options within 60 days of March 31, 2016.

(5) Includes 15,000 shares of the Company’s Common Stock and 30,000 shares of the Company’s Common Stock issuable upon exercise of stock options within 60 days of March 31, 2016.

(6) Consists of 927,673 shares of the Company’s Common Stock.

(7) Includes 18,750 shares of the Company’s Common Stock, and 77,870 shares of the Company’s Common Stock issuable upon the exercise of options within 60 days of March 31, 2016.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

AND RELATED PERSON TRANSACTIONS

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who beneficially own more than 10% of our equity securities (“Reporting Persons”) to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Based solely on our review of copies of such reports and representations from the Reporting Persons, we believe that during the fiscal year ended December 31, 2015,2018, all Reporting Persons were in compliance with the applicable requirements of Section 16(a) of the Exchange Act.

Transactions with Related Persons

During 2015,Heng Fai Holdings Limited purchased 800,000 shares of restricted common stock of the Company on September 8, 2017 in a private offering. The purchase price was $0.75 per share. As part of this private offering, Heng Fai Holdings Limited also received a warrant to purchase up to 160,000 additional shares of the Company’s common stock at an exercise price of $1.00 per share. Mr. Heng Fai Ambrose Chan is an officer and owner of Heng Fai Holdings Limited and has dispositive power over the shares. Mr. Chan is a director of the Company and a related party.

On September 12, 2017, Hengfai Business Development Pte Ltd received 683,000 shares of restricted common stock of the Company in connection with a Securities Exchange Agreement between the Company and Hengfai Business Development Pte Ltd. Mr. Heng Fai Ambrose Chan is the Chief Executive Officer and owner of Hengfai Business Development Pte Ltd and has dispositive power over the shares. Mr. Chan is a director of the Company and a related party.

On September 12, 2017, BMI Capital Partners International Limited exercised a warrant and purchased 200,000 shares of restricted common stock of the Company, at an exercise price of $0.75 per share. Mr. Heng Fai Ambrose Chan is a director of BMI Capital Partners International Limited and has dispositive power over the shares. Mr. Chan is a director of the Company and a related party.

On December 13, 2017, Heng Fai Holdings Limited exercised a warrant and purchased 160,000 shares of restricted common stock of the Company, at an exercise price of $1.00 per share. Mr. Heng Fai Ambrose Chan is an officer and owner of Heng Fai Holdings Limited and has dispositive power over the shares. Mr. Chan is a director of the Company and a related party.

On March 1, 2018, the Company entered into an Outsource Technology Development Agreement (the “Agreement”) with HotApp International Ltd., which may be terminated by either party on 30-days’ notice. The purpose of the Agreement is to facilitate the Company’s development of a software application to be included as part of the Company’s AuthentiGuard® Technology suite. Under the Agreement, the Company agreed to pay $23,000 per month for access to HotApp International Ltd.’s software programmers. The Company made its last payment under the Agreement in August 2018. Mr. Heng Fai Ambrose Chan is a principal owner of HotApp International Ltd and, as a director of the Company, is a related party.

On March 30, 2018, Joseph Sanders completed the purchase of 400,000 shares of restricted common stock of the Company pursuant to a Securities Purchase Agreement with the Company dated August 30, 2017, and received an immediately exercisable warrant to purchase up to an additional 80,000 shares of the Company’s common stock at an exercise price of $1.00 per share. Mr. Sanders currently is a director of the Company and a related party.

On May 31, 2019, the Company issued and sold an unsecured promissory note to LiquidValue Development Pte Ltd, an entity owned by Mr. Chan, in the principal amount of $650,000. Proceeds from the note were used for general corporate purposes. This Note was paid consultingin full on June 12, 2019.

On November 1, 2019, the Company entered into and closed on a subscription agreement (the “Subscription Agreement”) with Mr. Fai Heng Chan, Chairman of the Board of Directors of the Company. Pursuant to the Subscription Agreement, Mr. Chan purchased 6,000,000 shares of the Company’s common stock at a purchase price of $0.3037 per share, resulting in gross proceeds to the Company of $1,822,200, before deductions for placement agent fees of approximately $35,000 to Patrick White, its former CEO, under a consulting agreement. The agreement expired in March 2015, and all payments thereunder ceased at that time.other expenses.

Review, Approval or Ratification of Transactions with Related Persons

The Board conducts an appropriate review of and oversees all related party transactions on a continuing basis and reviews potential conflict of interest situations. The Board has adopted formal standards to apply when it reviews, approves or ratifies any related party transaction. In addition, the Board applies the following standards to such reviews: (i) all related party transactions must be fair and reasonable and on terms comparable to those reasonably expected to be agreed to with independent third parties for the same goods and/or services at the time they are authorized by the Board and (ii) all related party transactions should be authorized, approved or ratified by the affirmative vote of a majority of the directors who have no interest, either directly or indirectly, in any such related party transaction.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

INFORMATION ABOUT THE NOMINEES

The Company’s By-laws, as amended, specify that the number of directors shall be at least three and no more than nineeleven persons, unless otherwise determined by a vote of the majority of the Board of Directors. AllEffective December 9, 2019, the Board has reduced the number of the nominees named below have been nominated by the Companydirectors from nine to stand for election as incumbents.seven. Each director of the Company serves for a one-year term (or until the next annual meeting of stockholders) or until such director’s successor is duly elected and qualified or until such director’s earlier resignation or removal.

Biographical and certain other information concerning the Company’s nominees for election to the Board is set forth below. There are no familial relationships among any of our directors or nominees. Except as indicated below, none of our directorsthe nominees is a director in any other reporting companies. None of our directorsnominees has been affiliated with any company that has filed for bankruptcy within the last ten years. We are not aware of any proceedings to which any of our directors,nominees, or any associate of any such directornominee is a party adverse to us or any of our subsidiaries or has a material interest adverse to us or any of our subsidiaries.

BOARD NOMINEES

| Name | Age | |

| 56 | ||

| Sassuan Lee | 48 | |

| Jose Escudero | 44 | |

| William Wu | 53 |

The principal occupation and business experience for each director nominee, for at least the past five years, is as follows:

Robert B. FagensonHeng Fai Ambrose Chan spent the majority of his career at the New York Stock Exchange, where he was Managing Partner of onehas served as a director of the largest specialist firms operating onCompany since February 12, 2017. On September 11, 2017, Mr. Chan and the exchange trading floor. Having sold his firm and subsequently retired from that business in 2007, he has since beenCompany entered into an agreement whereby Mr. Chan also serves as the Chief Executive Officer of Fagenson & Co.,the Company’s wholly-owned subsidiary, DSS International Inc., a 50 year old broker dealer that Mr. Chan is engagedan expert in institutional brokerage as well as investment banking and money management. On March 1, 2012, Fagenson & Co., Inc. transferred its brokerage operations, accountsfinance, with years of experience in the industry. Mr. Chan has restructured 35 companies in various industries and personnel to National Securities Corporation and now operatescountries in the past 40 years. Mr. Chan currently serves as a branch office of that firm. On April 4, 2012, Mr. Fagenson was elected Chairman of the Board of National Holdings Corporation which is the parent of National Securities Corporation, a full line broker dealer with offices around the United States. On January 1, 2015, Mr. Fagenson was named Chief Executive Officer of NationalSingapore eDevelopment Limited (SED), a publicly traded company on the Singapore Stock Exchange. He also serves as a director of BMI Capital Partners International Ltd., a wholly-owned subsidiary of SED. Mr. Chan also serves on the board of Holista CollTech Limited, a publicly traded company listed on the Australian Securities Exchange.

Mr. Chan formerly served as (i) Managing Chairman of Heng Fai Enterprises Limited (now known as ZH International Holdings Corporation.Limited) which trades on the Hong Kong Stock Exchange; (ii) the Managing Director of SGX Catalist-listed SingHaiyi Group Ltd., which under his leadership, transformed from a failing store-fixed business provider with net asset value of less than $10 million into a property trading and investment company and finally to a property development company with net asset value over $150 million before Mr. Chan ceded controlling interest in late 2012; (iii) the Executive Chairman of China Gas Holdings Limited, a formerly failing fashion retail company listed on the Hong Kong Stock Exchange, which under his direction, was restructured to become one of the few large participants in the investment in and operation of city gas pipeline infrastructure in China; (iv) a director of Global Med Technologies, Inc., a medical company listed on NASDAQ engaged in the design, development, marketing and support information for management software products for healthcare-related facilities; (v) a director of Skywest Limited, an ASX-listed airline company; and (vi) the Chairman and Director of American Pacific Bank.

During

In 1987, Mr. Chan acquired American Pacific Bank, a full-service U.S. commercial bank, and brought it out of bankruptcy. He recapitalized, refocused and grew the bank’s operations. Under his careerguidance it became a NASDAQ-listed high asset quality bank with zero loan losses for over five consecutive years before it was ultimately bought and merged into Riverview Bancorp Inc. Prior to its acquisition and merger, it was ranked #13 by the Seattle Times “Annual Northwest’s Top 100 Public Companies”, and ranked #6 in Oregon state, ahead of names such as Nike, Microsoft, Costco, AT&T Wireless and Amazon.com. Mr. Chan’s international business contacts and executive leadership experience qualifies him to serve on the Company’s Board.

Frank D. Heuszelhas served as a director of the Company since July 30, 2018. Originally, Mr. Heuszel joined the DSS Board as an independent director and served as Chairman of the DSS Audit Committee. On April 11, 2019, the DSS Board appointed Mr. Heuszel as the Company’s Interim Chief Executive Officer and, on April 17, 2019, appointed him as the Company’s Interim Chief Financial Officer. On May 7, 2019, Mr. Heuszel was appointed as the Company’s permanent Chief Executive Officer. As a result of his appointment as an officer of the Company, Mr. Heuszel has been reclassified as a non-independent director.

Mr. Heuszel is a Certified Public Accountant (retired), a Certified Internal Auditor, a commercial banker, and a practicing attorney. Mr, Heuszel founded the Law Offices of Frank D. Heuszel in January of 2016, where he still practices today. Previously, he served as the Vice President and General Counsel of Patriot Bank from January 2013 through December 2015. He has over 40 years of experience in banking, accounting and finance, auditing, and turnaround management. As a banker, Mr. Heuszel served as Audit Manager, Chief Financial Officer, Senior Lender, and Director of Special Assets, Credit Officer, Director of Compliance, and General Counsel. As the Director of Special Assets for a large national banking organization, his division managed over $4.6 billion in assets. Because of his 30+ years of managing large corporate reorganization and restructures, Mr. Heuszel is recognized as an expert in the management of troubled companies.

As an attorney, Mr. Heuszel has served as general counsel for a regional Texas Bank and as a practicing attorney, his Houston based law practice provided legal and advisory services primarily focused on banking, finance, collection litigation, bankruptcy, mergers and acquisition, and corporate governance.

Mr. Heuszel’s experience and expertise in the areas of evaluating financial statements and complex financial transactions has been beneficial to the Company and well qualifies him for the roles that he serves for the Company.

Frank D. Heuszel graduated from the University of Texas at Austin from the McCombs School of Business with a BBA, and he received his JD from South Texas College of Law in 1990. Mr. Heuszel is a member of the New York Stock Exchange beginning in 1973, Mr. FagensonTexas State Bar, Association of Corporate Counsel, Texas Society of Certified Public Accountants, Houston Chapter of Certified Public Accountants, and the State Bar of Texas Bankruptcy Section.

Lo Wah Wai(also known as Lowell Lo) has served as a Governordirector of the Company since April 12, 2019. Mr. Lo is currently Chairman and Managing Director of the BMI Intelligence Group Limited, a leading corporate consulting and financial services firm in the Asia Pacific Region he founded in 1995, and is responsible for the overall management, strategic planning and development of the firm. Prior to establishing BMI Intelligence Group Limited, Mr. Lo was an Audit Manager at Deloitte Touche Tohmatsu for nine years, including two years of service in Deloitte’s U.S. headquarters. Mr. Lo has extensive experience with initial public offerings and has participated in the listings of several companies including Ajisen Remen, 361 Degrees Group, Lilanz Group and IGG. Mr. Lo’s professional qualifications include Hong Kong Certified Public Accountants (CPA), American Institute of Certified Public Accountants (AICPA), Information Systems Auditor and Control Association (ISACA) and Senior International Finance Manager (SIFM). Mr. Lo is also currently an independent, non-executive board member of Chongqing Machinery & Electric Co., Ltd. and Tenfu (Cayman) Holdings Company Limited, both Hong Kong Exchange-listed companies. Mr. Lo received his bachelor’s degree in Business Administration from the Chinese University of Hong Kong and a master’s degree from the New Jersey Institute of Technology. Mr. Lo’s financial expertise and experience in the management and strategic development of various companies qualifies him to serve on the trading floor and was elected to the NYSE Board of Directors in 1993, where he served for six years, eventually becoming Vice Chairman of the Board in 1998 and 1999. He returned to the NYSE Board in 2003 andCompany’s Board.

John Thatchhas served as a director untilof the BoardCompany since May 9, 2019. Mr. Thatch is an accomplished professional and entrepreneur who has started, owned and operated several businesses in various industries and in both the public and private arena. The industries in which his companies have operated include the service, retail, wholesale, education, finance, real estate management and technology industries. Since March 2018, Mr. Thatch has served as the Chief Executive Officer and a director of Sharing Services Global Corporation, a publicly traded holding company focused in the direct selling and marketing industry. He is also a principal owner of Superior Wine & Spirits, a Florida-based company that imports, wholesales and distributes wine and liquor throughout the State of Florida. He has been involved in this business venture since February of 2016. Mr. Thatch served as Chief Executive Officer of Universal Education Strategies, Inc. from January 2009 - January 2016, an organization consisting of six companies that specialized in the development and sales of educational products and services. From 2000 - 2005, he was reconstitutedthe Chief Executive Officer of Onscreen Technologies, Inc., currently listed on NASDAQ as CUI Global, Inc., a global leader in the development of cutting-edge thermal management technologies for integrated LED technologies, circuits and superconductors. Mr. Thatch was responsible for all aspects of the company including board and shareholder communications, public reporting and compliance with only non-industry directorsSarbanes-Oxley, structuring and managing the firm’s financial operations, and expansion initiatives for all corporate products and services. Mr. Thatch’s public company financial and management experience in 2004.the strategic growth and development of various companies qualify him to serve on the Company’s Board.

Mr. Fagenson has previously served on the boards ofSassuan (Samson) Leeco-founded STO Global X, a number of public companiestechnology and is presently the Non-Executive Chairman of the Board of Directors of Document Security Systems, Inc.service provider for security token exchange solutions, in December 2017. He has served as a director of the Company since 2004 andAugust 5, 2019. He has also served as the Board’s Non-Executive ChairmanChief Crypto-Economic Advisor for Gibraltar Stock Exchange and Gibraltar Blockchain Exchange since 2008. He isSeptember 2017. In November 2016, Mr. Lee founded Coinstreet Partners, a consultancy firm focused on blockchain, fintech, cryptocurrency and digital assets, and has served as its Chief Executive Officer since inception. Mr. Lee previously served as Managing Director at uCast Global Asia from December 2015 through November 2016. Mr. Lee also a directorserved as the Executive Vice President of the National Organization of Investment Professionals (NOIP).

In addition to his business related activities, Mr. Fagenson servesGreater China region at Movideo from June 2015 through December 2015 and as Vice President and a director of New York Services for the Handicapped, Treasurer and directorGeneral Manager of the Centurion Foundation,Greater China and South Asia Pacific regions at NeuLion Inc. from July 2008 through June 2015. Mr. Lee received his Bachelor of Commerce degree from the University of Toronto and his MBA and MS degrees from the Hong Kong University of Science and Technology. Mr. Lee’s extensive experience and recognized expert in the fields of technology, blockchain, cryptocurrency and fintech, combined with his experience as Chief Executive Officer and Managing Director of the Federal Law Enforcement Officers Association Foundation, Treasurer and director of the New York City Police Museum and as a member of the Board of the Sports and Arts in Schools Foundation. He is a member of the alumni boards of both the Whitman School of Business and the Athletic Department at Syracuse University. He also serves in a voluntary capacity on the boards and committees of many civic, social and community organizations. Mr. Fagenson received his B.S. degree in Transportation Sciences & Finance from Syracuse University in 1970. Mr. Fagenson’s extensive experience as a board member for many public companies and as a corporate executivesuccessful international businesses qualifies him to serve on our board of directors.the Company’s Board.

Jeffrey RonaldiJose Escudero has served as the Company’s Chief Executive Officer and director since July 1, 2013. Mr. Ronaldi had previously served as Lexington Technology Group, Inc.’s Chief Executive Officer since November 9, 2012. He also has served since July 2011 as Managing Director at HPR Capital, LLC; since January 2008 he has also served as Managing Partner of CTD Group, LLC andat BMI Capital Spain, a private investment bank, since June 2005, he has served as Managing Director of SSL Services, LLC. From November 2008 to November 2010, he served as Chief Executive Officer at Turtle Bay Technologies, an intellectual property management firm that provides strategic capital, asset management services and guidance for intellectual property owners. Since August 2008, Mr. Ronaldi has provided consulting services to Juridica Investments Ltd., a closed-end investment fund listed on the Alternative Investment Market (AIM) of the London Stock Exchange. Mr. Ronaldi’s experience with Turtle Bay Technologies and management of intellectual property qualifies him to serve on our board of directors.

Robert B. Bzdick joined the Company on February 17, 2010 as Chief Operating Officer after the Company’s acquisition of its wholly-owned subsidiary, Premier Packaging Corporation, for which Mr. Bzdick was the Chief Executive Officer. Mr. Bzdick became a director of the Company in March 2010 and Chief Executive Officer in December 2012. Mr. Bzdick resigned as Chief Executive Officer of the Company and was appointed President of the Company on July 1,September 2013. Prior to founding Premier Packaging Corporation in 1989, Mr. Bzdick held positions of Controller, Sales Manager, and General Sales Manager at the Rochester, New York division of Boise Cascade, LLC (later Georgia Pacific Corporation). Mr. Bzdick has over 29 years of experience in manufacturing and operations management in the printing and packaging industry. Mr. Bzdick brings his considerable packaging and printing industry experience to the Company, which qualifies him to serve on our board of directors.

Ira A. Greenstein is President of Genie Energy Ltd., an energy services company. Prior to joining Genie Energy Ltd. in December 2011, Mr. Greenstein served as President of IDT Corporation (NYSE: IDT), a provider of wholesale and retail telecommunications services and continues to serve as counsel to the Chairman. Prior to joining IDT in January 2000, Mr. Greenstein was a partner in the law firm of Morrison & Foerster LLP from February 1997 to November 1999, where he served as the chairman of the firm’s New York Business Department. Concurrent to his tenure at Morrison & Foerster, Mr. Greenstein served as General Counsel and Secretary of Net2Phone, Inc. from January 1999 to November 1999. Prior to 1997, Mr. Greenstein was an associate in the New York and Toronto offices of Skadden, Arps, Meagher & Flom LLP. Mr. Greenstein also served on the Securities Advisory Committee to the Ontario Securities Commission from 1992 through 1996. From 1991 to 1992, Mr. Greenstein served as second counsel to the Ontario Securities Commission. Mr. Greenstein serves on the boards of Ohr Pharmaceutical, Inc., NanoVibronix Inc. and Regal Bank of New Jersey. Mr. Greenstein is a member of the Dean’s Council of the Columbia Law School Center on Corporate Governance. Mr. Greenstein received a B.S. from Cornell University and a J.D. from Columbia University Law School. Mr. Greenstein was appointed to our Board of Directors in September 2004.

Mr. Greenstein provides the Company with significant public company management experience, particularly in regards to legal and corporate governance matters, mergers and acquisitions, and strategic planning. In addition, Mr. Greenstein’s extensive legal experience has provided the Company insights and guidance throughout the Company’s patent litigation initiatives. All of this experience qualifies him to serve on our board of directors.

Warren HurwitzHe has served as a director of the Company since August 5, 2019. Previously, Mr. Escudero served as Principal at Hallman & Burke, an international consulting firm, from July 1,2009 through September 2013. Mr. HurwitzEscudero has served since March 2005 as a partner of Altitude Capital Partners, a private investment fund that he co-founded that is focused on investing in, enforcing and protecting the rights of intellectual property assets. Prior to Altitude Capital Partners, Mr. Hurwitz was a Senior Vice President at HSBC Capital (USA), the U.S. private equity arm of HSBC Group, from May 2001 through June 2004 and has held various positions within HSBC Markets (USA) Inc. from June 1994 through May 2001. Mr. Hurwitz received his B.A. degreeB.Sc. in Economics from the StateFrancisco de Vitoria University of New York at Albany and a Master’s degree in Corporate Finance and Investment Banking from the Options & Futures Institute. Mr. Escudero’s experience in merger and acquisitions, corporate finance, and international trade along with his MBA from Fordham University. Mr. Hurwitz’s experience with Altitude Capital Partnerseducation in economics and thefinance and investment enforcement and protection of intellectual property rights qualifybanking qualifies him to serve on our board of directors.the Company’s Board.

Joseph SandersWilliam Wu has served as the managing director of Investment Banking at Glory Sun Securities Limited since January 2019. Mr. Wu previously served as the executive director and chief executive officer of Power Financial Group Limited from November 2017 to January 2019. Mr. Wu has served as a director of the CompanyAsia Allied Infrastructure Holdings Limited since October 1,February 2015. Mr. Sanders graduated with a BS in Business Administration and Finance from the University of Southern California and went on to receive an MBA in Finance from Loyola Marymount University. He received his license as a financial advisor in 1981, and then worked as a financial analyst at Hughes Aircraft for two years. Thereafter, between 1983 and 2001, Mr. SandersWu previously served as a director and chief executive officer of RHB Hong Kong Limited from April 2011 to October 2017. Mr. Wu served as the chief executive officer of SW Kingsway Capital Holdings Limited (now known as Sunwah Kingsway Capital Holdings Limited) from April 2006 to September 2010. Mr. Wu holds a Bachelor of Business Administration degree and a Master of Business Administration degree of Simon Fraser University in Canada. He was qualified as a chartered financial advisor at Dean Witter, EF Hutton, Shearson Lehman, Bateman Eichler, AG Edwards, Sutroanalyst of The Institute of Chartered Financial Analysts in 1996.

Mr. Wu previously worked for a number of international investment banks and Morgan Stanley. Since 2001,possesses over 26 years of experience in the investment banking, capital markets, institutional broking and direct investment businesses. He is a registered license holder to carry out Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activities under the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). Mr. SandersWu has served as a Registered Investment Advisor with a firm now known as Newport Coast Securities. Allmember of thisthe Guangxi Zhuang Autonomous Region Committee of the Chinese People’s Political Consultative Conference in January 2013. Mr. Wu’s experience in banking, capital markets, investment banking, Asian economic and banking dynamics, and education in corporate finance and asset management qualifies him to serve on our boardthe Company’s Board.

Each of directors.Lo Wah Wai, John Thatch Sassuan Lee, Jose Escudero and William Wu were recommended for election by the Company’s Chief Executive Officer, Chairman of the Board and/or the Nominating and Corporate Governance Committee at the time of their respective prior appointments to the Board

Information Regarding Opposing Slate of Directors

There are no legal proceedingsJ. Marvin Feigenbaum, Barinder Athwal and Brian Mirman (collectively, the “Concerned Shareholder Group”) have notified the Company of their intent to nominate an alternative slate of individuals for election as directors at the Annual Meeting in opposition to the nominees recommended by our Board of Directors. Our Board does not endorse any alternate director nominees. If the Concerned Shareholder Group proceeds with its alternative director nominations, you may receive proxy solicitation materials from or on behalf of the Concerned Shareholder Group, including an opposition proxy statement and proxy card. The Company is not responsible for the accuracy of any information contained in any proxy solicitation materials used by the Concerned Shareholder Group or any other statements that have occurred within the past ten years concerning our directors which involved a criminal conviction, a criminal proceeding, an administrative or civil proceeding limiting one’s participation in the securities or banking industries, or a finding of securities or commodities law violations.it may otherwise make.

| 13 |

RECOMMENDATION OF THE BOARD FOR PROPOSAL NO. 1:

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL THE NOMINEES DESCRIBEDNAMED ABOVE.

INFORMATION CONCERNING BOARD OF DIRECTORS

Compensation of Directors

Each independent director (as defined under Section 803 of the NYSE MKTAMERICAN LLC Company Guide) is entitled to receive base cash compensation of $12,000 annually, provided such director attends at least 75% of all Board of Director meetings, and all scheduled committee meetings. Each independent director is entitled to receive an additional $1,000 for each Board of DirectorDirectors meeting he or she attends, and an additional $500 for each committee meeting he or she attends, provided such committee meeting falls on a date other than the date of a full Board of Directors meeting. Each of the independent directors iswill also be eligible to receive discretionary grants of options or restricted stock under the Company’s 2013 Employee, Director and Consultants2019 Equity Incentive Plan.Plan, if approved. Non-independent members of the Board of Directors do not receive cash compensation in their capacity as directors, except for reimbursement of travel expenses.

Director Compensation

The following table sets forth the cash compensation and the value of stock options awards granted to the Company’s non-employee independentCompany directors for their service in 2015:during the Company’s fiscal year ended December 31, 2018:

| Name | Fees Earned or Paid in Cash | Stock Awards | Option Awards(1) (2) | Total | ||||||||||||

| ($) | ($) | ($) | ($) | |||||||||||||

| Robert B. Fagenson | 12,000 | - | 3,213 | 15,213 | ||||||||||||

| Ira A. Greenstein | 10,500 | - | 3,213 | 13,713 | ||||||||||||

| Joseph Sanders | 1,000 | - | - | 1,000 | ||||||||||||

| Warren Hurwitz | 11,500 | 3,200 | - | 14,700 | ||||||||||||

| Jonathan Perrelli (3) | 1,500 | 3,200 | - | 4,700 | ||||||||||||

| Fees Earned or | Stock | Option | ||||||||||||||

| Name | Paid in Cash | Awards | Awards (1) | Total | ||||||||||||

| ($) | ($) | ($) | ($) | |||||||||||||

| Robert B. Fagenson (2) | 7,500 | - | 8,200 | 15,700 | ||||||||||||

| Pamela Avallone (5) | 19,000 | - | 8,200 | 27,200 | ||||||||||||

| Joseph Sanders | 18,500 | - | 8,200 | 26,700 | ||||||||||||

| Warren Hurwitz (2) | 8,000 | - | 8,200 | 16,200 | ||||||||||||

| Frank Heuszel (3) | 9,500 | - | - | 9,500 | ||||||||||||

| William Lerner (2) | 7,500 | - | 8,200 | 15,700 | ||||||||||||

| Clark Marcus (4) | 19,500 | - | 8,200 | 27,700 | ||||||||||||

| Daniel DelGiorno | - | - | - | - | ||||||||||||

| Heng Fai Ambrose Chan | - | - | - | - | ||||||||||||

(1) Represents the total grant date fair value of option awards computed in accordance with FASB ASC 718. Our policy and assumptions made in the valuation of share-based payments are contained in Note 9 to our consolidated financial statements for the year ended December 31, 2018.

(2) Resigned as a director of the Company as of June 1, 2018.

(3) Mr. Heuszel’s service as a director of the Company commenced on July 30, 2018. As of April 11, 2019, Mr. Heuszel is no longer an independent director.

(4) Resigned as a director of the Company as of May 1, 2019.

(5) Resigned as a director of the Company as of October 1, 2019.

Board of Directors and Committees

The Company has determined that each of the following directors, Messrs. Hurwitz, Fagenson,William Wu, Joseph Sanders, Sassuan Lee and Greenstein,Jose Escudero qualify as independent directors (as defined under Section 803 of the NYSE MKTAmerican LLC Company Guide).

In fiscal 2015,2018, each of the Company’s directors attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board of Directors held during the period in which each such director served as a director and (ii) the total number of meetings held by all committees of the Board of Directors during the period in which each such director served on such committee. During the fiscal year ended December 31, 2015,2018, the Board held four12 meetings and acted by written consent on twelve4 occasions. The Board’s independent directors met in executive session on one occasionoccasions outside the presence of the non-independent directors and management.

Audit Committee

The Company has separately designated an Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee held four meetings in 2015.2018, and acted by written consent on two occasions. The Audit Committee is responsible for, among other things, the appointment, compensation, removal and oversight of the work of the Company’s independent registered public accounting firm, overseeing the accounting and financial reporting process of the Company, and reviewing related person transactions. TheAs of year-end 2018, the Audit Committee was comprised of Frank D. Heuszel and Joseph Sanders. Currently, the Audit Committee is currently comprised of Robert FagensonJohn Thatch and Warren Hurwitz. It is anticipated that eachSassuan Lee. Each of Mr. FagensonThatch and Mr. Hurwitz will be re-appointed to serve as members of the Audit Committee at the Company’s Annual Meeting of Directors. Robert FagensonLee is qualified as a “financialan “audit committee financial expert” as defined in Item 407 under Regulation S-K of the Securities Act of 1933, as amended. Each of the members of the Audit Committee isamended, and as an independent director (asas defined under Section 803 of the NYSE MKTAmerican LLC Company Guide).Guide. John Thatch serves as Chairman of the Audit Committee. The Audit Committee operates under a written charter adopted by the Board of Directors, which can be found in the Investors/Corporate Governance section of our web site, www.dsssecure.com.www.dsssecure.com.

Compensation and Management Resources Committee

The purpose of the Compensation and Management Resources Committee is to assist the Board in discharging its responsibilities relating to executive compensation, succession planning for the Company’s executive team, and to review and make recommendations to the Board regarding employee benefit policies and programs, incentive compensation plans and equity-based plans. The Compensation and Management Resources Committee held three meetings in 2018 and two meetings in 2015.2019.

The Compensation and Management Resources Committee is responsible for, among other things, (a) reviewing all compensation arrangements for the executive officers of the Company and (b) administering the Company’s stock option plans. TheAt the close of 2018, the Compensation and Management Resources Committee currentlywas comprised of Pamela Avallone, Clark Marcus and Joseph Sanders. Currently, the Compensation and Management Resources Committee consists of Ira GreensteinJose Escudero, Sassuan Lee and Robert Fagenson.Joseph Sanders, with Joseph Sanders as the Chairman. Each of the members of the Compensation and Management Resources Committee is an independent director (as defined under Section 803 of the NYSE MKT LLCAmerican Company Guide). It is anticipated that Mr. Fagenson and Mr. Greenstein will be re-appointed to serve as members of the Compensation and Management Resources Committee at the Company’s Annual Meeting of Directors. The Compensation and Management Resource Committee operates under a written charter adopted by the Board of Directors, which can be found in the Investors/Corporate Governance section of our web site, www.dsssecure.com.www.dsssecure.com.

The duties and responsibilities of the Compensation and Management Resources Committee in accordance with its charter are to review and discuss with management and the Board the objectives, philosophy, structure, cost and administration of the Company’s executive compensation and employee benefit policies and programs; no less than annually, review and approve, with respect to the Chief Executive Officer and the other executive officers (a) all elements of compensation, (b) incentive targets, (c) any employment agreements, severance agreements and change in control agreements or provisions, in each case as, when and if appropriate, and (d) any special or supplemental benefits; make recommendations to the Board with respect to the Company’s major long-term incentive plans applicable to directors, executives and/or non-executive employees of the Company and approve (a) individual annual or periodic equity-based awards for the Chief Executive Officer and other executive officers and (b) an annual pool of awards for other employees with guidelines for the administration and allocation of such awards; recommend to the Board for its approval a succession plan for the Chief Executive Officer, addressing the policies and principles for selecting a successor to the Chief Executive Officer, both in an emergency situation and in the ordinary course of business; review programs created and maintained by management for the development and succession of other executive officers and any other individuals identified by management or the Compensation and Management Resources Committee; review the establishment, amendment and termination of employee benefits plans, review employee benefit plan operations and administration; and any other duties or responsibilities expressly delegated to the Compensation and Management Resources Committee by the Board from time to time relating to the Committee’s purpose.

The Compensation and Management Resources Committee may request any officer or employee of the Company or the Company’s outside counsel to attend a meeting of the Compensation and Management Resources Committee or to meet with any members of, or consultants to, the Compensation and Management Resources Committee. The Company’s Chief Executive Officer does not attend any portion of a meeting where the Chief Executive Officer’s performance or compensation is discussed, unless specifically invited by the Compensation and Management Resources Committee.

The Compensation and Management Resources Committee has the sole authority to retain and terminate any compensation consultant to be used to assist in the evaluation of director, Chief Executive Officer or other executive officer compensation or employee benefit plans, and shall havehas sole authority to approve the consultant’s fees and other retention terms. The Compensation and Management Resources Committee also has the authority to obtain advice and assistance from internal or external legal, accounting or other experts, advisors and consultants to assist in carrying out its duties and responsibilities, and has the authority to retain and approve the fees and other retention terms for any external experts, advisors or consultants.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for overseeing the appropriate and effective governance of the Company, including, among other things, (a) nominations to the Board of Directors and making recommendations regarding the size and composition of the Board of Directors and (b) the development and recommendation of appropriate corporate governance principles. TheAt the close of 2018, the Nominating and Corporate Governance Committee currentlywas comprised of Pamela Avallone, Clark Marcus and Joseph Sanders. Currently, the Nominating and Corporate Governance Committee consists of Ira GreensteinJohn Thatch, the Chairman of the committee, Sassuan Lee and Robert Fagenson,Jose Escudero, each of whom is an independent director (as defined under Section 803 of the NYSE MKTAmerican LLC Company Guide). It is anticipated that Mr. Greenstein and Mr. Fagenson will be re-appointed at the Company’s Annual Meeting of Directors to serve as members of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee held one meetingthree meetings in 2015.2018, and did not act by written consent. The Nominating and Corporate Governance Committee operates under a written charter adopted by the Board of Directors, which can be found in the Investors/Corporate Governance section of our web site, www.dsssecure.com. The Nominating and Corporate Governance Committee adheres to the Company’s By-Laws provisions and Securities and Exchange Commission rules relating to proposals by shareholders when considering director candidates that might be recommended by stockholders, along with the requirements set forth in the committee’s Policy with Regard to Consideration of Candidates Recommended for Election to the Board of Directors, also available on our website. The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying and selecting qualified candidates for election to the Board of Directors prior to each annual meeting of the Company’s stockholders. In identifying and evaluating nominees for director, the Committee considers each candidate’s qualities, experience, background and skills, as well as other factors, such as the individual’s ethics, integrity and values which the candidate may bring to the Board of Directors.

Code of Ethics

The Company has adopted a code of Ethics that establishes the standards of ethical conduct applicable to all directors, officers and employees of the Company. A copy of the Code of Ethics covering all of our employees, directors and officers, is available on the Investors/Corporate Governance section of our web site at www.dsssecure.com.

Leadership Structure and Risk Oversight

Currently, the positions of Chief Executive Officer and Chairman of the Board are held by two different individuals. Robert FagensonHeng Fai Ambrose Chan currently serves as Chairman of the Board and Jeffrey RonaldiFrank D. Heuszel currently serves as Chief Executive Officer and Interim Chief Financial Officer of the Company and as a member of the Board. Although no formal policy currently exists, the Board determined that the separation of these positions would allow our Chief Executive Officer to devote his time to the daily execution of the Company’s business strategies and the Board Chairman to devote his time to the long-term strategic direction of the Company. Our senior management manages the risks facing the Company under the oversight and supervision of the Board. While the full Board is ultimately responsible for risk oversight at our Company, two of our Board committees assist the Board in fulfilling its oversight function in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk in the areas of financial reporting and internal controls. The Nominating and Corporate Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to risk in the area of corporate governance. Other general business risks such as economic and regulatory risks are monitored by the full Board. While the Board oversees the Company’s risk management, management is responsible for day-to-day oversight of risk management processes.

Compensation Risk Assessment

Our Board considered whether our compensation program encouraged excessive risk taking by employees at the expense of long-term Company value. Based upon its assessment, the Board does not believe that our compensation program encourages excessive or inappropriate risk-taking. The Board believes that the design of our compensation program does not motivate imprudent risk-taking.

DIRECTOR NOMINATIONS

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying and selecting qualified candidates for election to the Board of Directors prior to each annual meeting of the Company’s stockholders. A copy of the Nominating and Corporate Governance Committee Charter is available on the Investors/Corporate Governance/Charters section of our web site, www.dsssecure.com. Any security holder who desires the Nominating and Corporate Governance Committee to consider one or more candidates for nomination as a director should either by personal delivery or by United States mail, postage prepaid, deliver a written recommendation addressed to the Chairman, Document Security Systems, Inc. Nominating and Corporate Governance Committee at 200 Canal View Boulevard, Suite 300, Rochester, New York 14623, not later than (i) with respect to an election to be held at an annual meeting of stockholders, 90 days prior to the anniversary date of the immediately preceding annual meeting or if an annual meeting has not been held in the preceding year, 90 days prior the first Tuesday in April; and (ii) with respect to an election to be held at a special meeting of stockholders for the election of directors, the close of business on the tenth day following the date on which notice of such meeting is first given to stockholders. Each written recommendation should set forth: (a) the name and address of the stockholder making the recommendation and of the person or persons recommended; (b) the consent of such person(s) to serve as a director(s) of the Company if nominated and elected; and (c) description of how the person(s) satisfy the General Criteria for consideration as a candidate referred to above. In addition, stockholders who wish to recommendnominate a candidate for election to the Board of Directors must submit a written notice of such recommendation to the Company and strictly comply with all the requirements set forth in the Nominating and Corporate Governance Committee Policy With Regard to Consideration of Candidates Recommended for Election to the Board of Directors, a copy of which is also available on the Investors/Charters section of our web site. The standards for considering nominees to the Board are included in the Corporate Governance Committee Charter. In identifying and evaluating nominees for director, the Committee considers each candidate’s qualities, experience, background and skills, as well as other factors, such as the individual’s ethics, integrity and values which the candidate may bring to the Board of Directors. Any stockholder who desires the Committee to consider one or more candidates for nomination as a director should either by personal delivery or by United States mail, postage prepaid, deliver a written notice of recommendation addressed to: Document Security Systems, Inc., Nominating and Corporate Governance Committee, 200 Canal View Boulevard, Suite 300, Rochester, New York 14623. Each written notice must set forth: (a) the name and address of the stockholder making the recommendation and of the person or persons recommended, (b) a representation that the stockholder is a holder of record of the stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, (c) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder, (d) such other information regarding each nominee proposed by such stockholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC, (e) the consent of such person(s) to serve as a director(s) of the Company if nominated and elected, and (f) a description of how the person(s) satisfy the criteria for consideration as a candidate referred to above.

COMMUNICATION WITH DIRECTORS

The Company has established procedures for stockholders or other interested parties to communicate directly with the Board of Directors. Such parties can contact the Board of Directors by mail at: Document Security Systems, Inc., Board of Directors, Attention: Robert Fagenson,Heng Fai Ambrose Chan, Chairman of the Board, 200 Canal View Boulevard, Suite 300, Rochester, New York 14623. All communications made by this means will be received by the Chairman of the Board.

AUDIT COMMITTEE REPORT